As a foreigner, the prospect of buying property in Mexico can be both exciting and daunting. With its stunning beaches, rich culture, affordable cost of living, and growing expat communities, Mexico has become an increasingly popular destination for real estate investment and retirement.

Navigating the legal and cultural landscape of property purchase in a foreign country can be complex. In this comprehensive guide, we’ll explore the ins and outs of Mexican real estate, covering everything from ownership laws to negotiation strategies, to help you make an informed decision.

Can You Purchase And Own Property In Mexico As A Foreigner?

The short answer is yes, foreigners can legally purchase and own property in Mexico under the same constitutional rights as Mexican citizens. There are certain restrictions and legal requirements to be aware of, particularly when it comes to property located within the Restricted Zones.

These restricted zones, known as the Prohibited Zones, encompass areas within 100 kilometers (62 miles) of Mexico’s borders and 50 kilometers (31 miles) from coastlines. In these areas, foreign nationals cannot directly own the land or property. However, they can legally acquire and hold residential property rights through a special property trust called a fideicomiso or a Mexican corporation.

Can You Become A Resident In Mexico By Purchasing And Owning Property?

Owning residential property in Mexico does not automatically grant you residency status.It can be a significant factor in obtaining a temporary or permanent residency visa. The Mexican government considers factors such as property investment, financial solvency, income sources, and overall economic ties to the country when evaluating residency applications from foreign nationals.

Having a substantial investment, such as a property purchase, demonstrates your commitment to Mexico and can strengthen your residency application. It’s important to note that residency requirements may vary based on your specific circumstances, and professional guidance from an immigration lawyer is recommended.

Also Read: Money6x Real Estate : Exploring Money6x’s Role In Real Estate Investment 2024

What Does the Real Estate Market Look Like in Mexico?

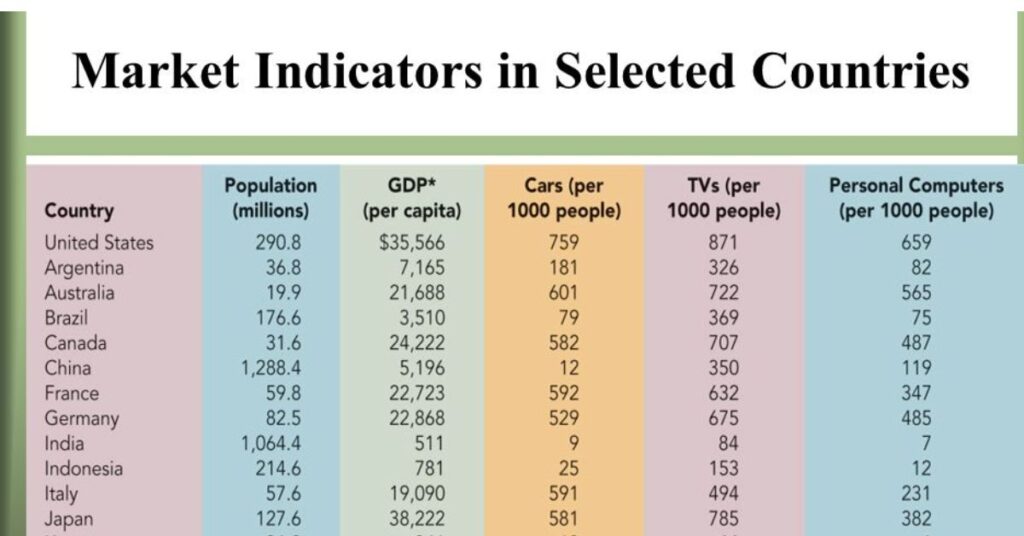

Market Indicators

Mexico’s real estate market has experienced steady growth in recent years, attracting both domestic and foreign buyers. According to the Mexican Association of Real Estate Professionals (AMPI), the average property prices in popular tourist destinations like Cancun, Playa del Carmen, and Los Cabos have increased by approximately 5-10% annually over the past five years.

The AMPI reports that in 2022, the total value of residential property sales in Mexico reached approximately $16.5 billion USD, with a significant portion (around 20%) of buyers being foreign nationals, primarily from the United States, Canada, and Europe.

The Expat Life

Mexico has long been a favorite destination for expats, particularly retirees from the United States and Canada. The lower cost of living, warm climate, vibrant culture, and proximity to their home countries have drawn many foreigners to establish roots in Mexico. According to estimates, there are over 1 million Americans and 300,000 Canadians living in Mexico as expats or retirees.

Popular expat hotspots include:

- Puerto Vallarta

- Cabo San Lucas

- San Miguel de Allende

- Lake Chapala (Ajijic, Chapala)

- Merida

- Ensenada

- Mazatlan

These areas offer a combination of affordable living, established expat communities, and access to amenities and services catering to foreign residents.

What Are The Best Places To Invest In Real Estate In Mexico?

While investment opportunities exist throughout the country, some areas have proven particularly attractive for foreign buyers:

It’s important to research and understand the specific market dynamics, infrastructure, and amenities of each area to align with your investment goals and lifestyle preferences.

| City / Region | Population | Average Price per sqm (MXN) | Strengths |

| Mexico City | ≈ 9 million | 25,000 – 50,000 | Capital city, cultural and historical sites, vibrant arts scene |

| Cancún | ≈ 750,000 | 30,000 – 70,000 | Tourist destination, beautiful beaches, water activities, nightlife |

| Playa del Carmen | ≈ 300,000 | 35,000 – 60,000 | Tourist hotspot, beach town, shopping and dining options |

| Guadalajara | ≈ 5 million | 15,000 – 35,000 | Cultural and artistic center, historic sites, thriving food scene |

| Puerto Vallarta | ≈ 300,000 | 25,000 – 45,000 | Tropical beach town, water sports, cobblestone streets, art galleries |

| Tulum | ≈ 40,000 | 30,000 – 60,000 | Archaeological site, eco-tourism, cenotes, bohemian atmosphere |

| Mérida | ≈ 1 million | 15,000 – 30,000 | Colonial city, Mayan heritage, cultural events, low cost of living |

Do You Need A Lawyer To Buy Real Estate In Mexico?

While not legally required, it is highly recommended to hire a reputable Mexican real estate lawyer or notary public (notario público) to guide you through the property purchase process. A knowledgeable legal professional can ensure that you comply with all legal requirements, verify property titles, and protect your interests as a foreign buyer.

Some key benefits of working with a real estate lawyer in Mexico include:

- Conducting thorough due diligence and title searches to ensure the property has a clear and legal chain of ownership.

- Navigating the complexities of the fideicomiso trust or Mexican corporation setup if purchasing in a restricted zone.

- Reviewing and negotiating the purchase agreement (escritura) to ensure your rights and interests are protected.

- Handling the transfer of funds and escrow arrangements to ensure a secure transaction.

- Assisting with the registration of the property ownership with the appropriate authorities.

- Advising on tax implications, residency requirements, and other legal considerations related to your property purchase.

Also Read: Top 10 Real Estate Social Network Platforms – Boost Your Business

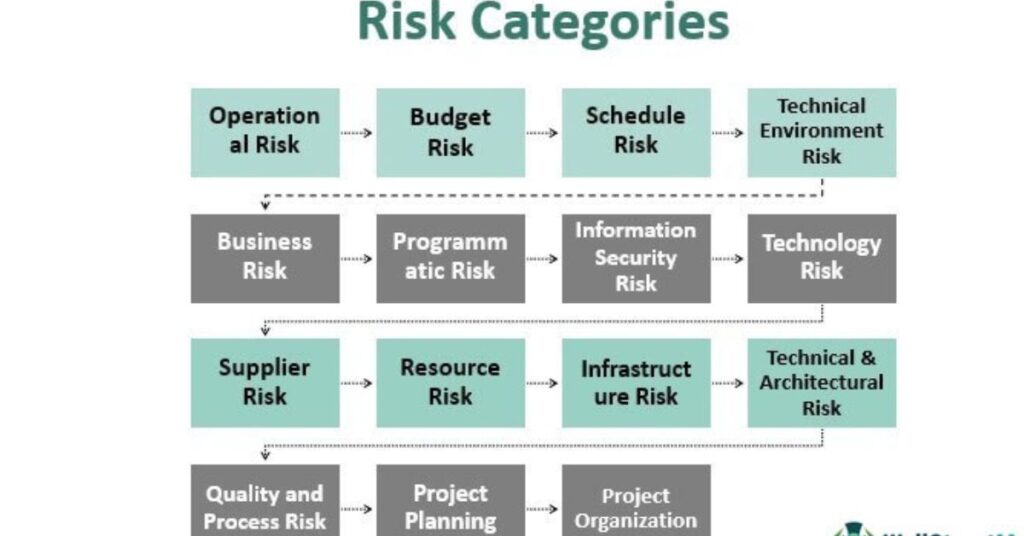

What Are The Risks When Purchasing Property In Mexico?

Like any real estate investment, there are inherent risks to be aware of when buying property in Mexico.

Here are some common concerns:

1. Ejido Land and Agrarian Law

Ejido lands are communally owned by local agrarian communities and governed by Mexico’s Agrarian Law. Purchasing property on ejido land can be complex and may require additional legal steps, such as establishing a bank trust (fideicomiso) or seeking approval from the ejido assembly.

2. Foreign Ownership Restrictions

As mentioned earlier, there are restricted zones along Mexico’s borders and coastlines where foreign ownership is limited. In these areas, foreigners must acquire property through a bank trust (fideicomiso) or a Mexican corporation, which can add additional costs and legal complexities.

3. Title and Ownership Verification

Conducting thorough due diligence and title searches is crucial to ensure the property has a clear and legal chain of ownership. Unresolved liens, disputes, or property scams can lead to costly legal battles and potential loss of your investment.

4. Property Scams and Fraud

Unfortunately, property scams and fraudulent activities do occur in Mexico’s real estate market. Common scams may involve false or forged ownership documents, illegal land sales, or misrepresentation of property conditions or zoning.

Working with reputable professionals, conducting extensive research, and exercising caution can help mitigate these risks. It’s also advisable to avoid transactions that seem too good to be true or involve unusual payment methods or pressure tactics.

5. Construction Quality and Building Permits

It’s essential to verify that the property was constructed with proper building permits and meets local construction quality standards. Unauthorized or substandard construction can lead to legal issues, safety concerns, and potential fines or demolition orders from authorities.

Hiring a qualified inspector to assess the property’s condition and compliance with building codes is highly recommended, especially for older properties or new constructions.

6. Infrastructure and Services

In some areas, particularly rural or remote locations, the availability of reliable infrastructure and services (e.g., utilities, roads, healthcare) may be limited or inconsistent. Researching the local infrastructure and amenities.

7. Natural Hazards and Environmental Risks

Mexico is prone to various natural hazards, such as earthquakes, hurricanes, and flooding, depending on the region. Assessing the property’s potential exposure to these risks is crucial, as they can impact not only your safety but also the value and insurability of your investment.

For example, coastal areas in states like Quintana Roo, Baja California Sur, and Jalisco may be at higher risk of hurricane damage, while inland regions like Mexico City and Puebla are more susceptible to earthquakes. Conducting due diligence on the property’s location and obtaining appropriate insurance coverage can help mitigate these risks.

8. Local Market Knowledge and Cultural Differences

As a foreign buyer, it’s essential to understand the local real estate market, cultural norms, and business practices, which can differ significantly from your home country. Failing to account for these differences can lead to misunderstandings, unrealistic expectations, or even legal issues.

Negotiation styles, contract formalities, and closing timelines may vary considerably from what you are accustomed to. Local customs, such as personal connections (known as “palanca”) and relationship-building, can also play a crucial role in real estate transactions.

What Are the Documents Needed for a Real Estate Transaction in Mexico?

To complete a property transaction in Mexico, you’ll typically need to provide the following documents:

- Valid government-issued identification (e.g., passport, national ID)

- Proof of income or financial solvency (e.g., tax returns, bank statements)

- Bank statements or proof of funds for the purchase

- Purchase agreement or “escritura” (the official deed)

- Property title and ownership documentation (e.g., titulo de propiedad)

- Tax receipts and payment records (e.g., predial, agua)

- Building permits and construction documentation (if applicable)

- Residency documentation (if applicable, e.g., temporary or permanent residency visa)

If you’re purchasing through a fideicomiso trust or Mexican corporation, additional documents may be required, such as the trust agreement or corporate bylaws.

Your real estate lawyer or notary public can guide you through the specific document requirements and ensure compliance with local regulations. They will also handle the preparation and authentication of the necessary legal documents for the transaction.

What Are the Tips for Negotiating with Mexican People Effectively?

Negotiating in Mexico often involves different cultural norms and expectations compared to other countries. Here are some tips for effective negotiation when buying property in Mexico:

- Build personal connections and establish trust (confianza): In Mexican culture, personal relationships and trust are highly valued in business dealings. Take the time to build rapport and establish a personal connection with the other party.

- Be patient and avoid excessive urgency or pressure: Negotiations in Mexico tend to move at a more relaxed pace. Avoid coming across as overly aggressive or impatient, as this can be perceived as disrespectful.

- Understand and respect cultural differences and local customs: Familiarize yourself with Mexican cultural norms, such as greeting etiquette, communication styles, and the importance of personal connections (palanca). Respect and adapt to these customs to foster a positive relationship.

- Demonstrate flexibility and a willingness to compromise: Negotiation in Mexico is often seen as a collaborative process, with both parties seeking a mutually beneficial outcome. Be open to compromises and creative solutions.

- Maintain a positive and respectful attitude throughout the process: Even during tough negotiations, maintain a polite and respectful demeanor. Avoid confrontational or aggressive behavior, as it can damage the relationship and hinder progress.

Involving a local real estate professional or attorney can help bridge cultural gaps and facilitate smoother negotiations. They can provide valuable insights into local customs and norms, as well as act as intermediaries when needed.

Can Foreigners Obtain a Bank Loan in Mexico?

Yes, it is possible for foreigners to obtain property financing or mortgage loans from Mexican banks or specialized lenders. However, the requirements and terms may vary based on factors such as residency status, income sources, and credit history. Some key considerations include:

- Down payment requirements: Typically, Mexican lenders require higher down payments from foreign buyers, often ranging from 30-50% of the property value.

- Loan-to-value (LTV) ratios and borrowing limits: Lenders may cap the maximum loan amount based on the property’s appraised value, usually around 60-70% LTV for foreigners.

- Mortgage rates and fees: Interest rates and associated fees (e.g., origination fees, appraisal costs) can vary depending on the lender and your specific circumstances.

- Documentation requirements: Expect to provide extensive documentation, including proof of income (e.g., tax returns, employment contracts), credit history, and financial assets.

- Residency status: Non-residents may face stricter lending criteria and higher interest rates compared to temporary or permanent residents.

It’s essential to research and compare options from different Mexican lenders and seek professional guidance from a mortgage broker or financial advisor. They can help you understand the legal requirements, available loan products, and the implications of obtaining a property loan in Mexico as a foreign national.

What Are the Taxes Related to Property Transactions in Mexico?

Here is a breakdown of taxes related to a property transaction in Mexico:

| Tax | Description | Calculation | Who pays |

| Rental Income Tax | Tax on rental income generated from the property | 25% on their gross rental income | Owner |

| Acquisition Tax | Tax on property acquisition | Varies from 2% to 5% of the property value, depending on the state | Buyer |

| Property Tax | Annual tax on real estate property | 0.1% on the property’s assessed value | Owner |

| Capital Gains Tax | Tax on the profit from property sale | 25% on the net capital gain (the difference between sale price and acquisition cost) | Seller |

It’s crucial to consult with a qualified tax professional or your real estate lawyer to understand your specific tax obligations and plan accordingly. Proper tax planning can help you avoid unexpected liabilities and ensure compliance with Mexican tax laws.

What Fees Are Involved in a Property Transaction in Mexico?

Below is a simple breakdown of fees for a property transaction in Mexico:

| Fee | Description | Calculation | Who pays |

| Real Estate Agent Fee | Fee charged by real estate agents for their services | Usually 5% to 8% of the property’s selling price | Seller |

| Registration Fee | Fees for registering the property transfer | Varies between 0.5% to 1% of the property value, depending on the state | Buyer |

| Notary Fees | Fees for notarial services | From 0.075% to 1.125% of the property value | Buyer |

It’s essential to budget for these additional costs and discuss them with your real estate professional or lawyer to fully understand the total expenses involved in the property transaction.

How to Send Payment for a Property Purchase in Mexico?

When it comes to making payments for a property purchase in Mexico, there are a few common methods:

Property Purchases in Mexico and Escrows

For larger transactions, it is recommended to use an escrow service or “fideicomiso” to facilitate the safe transfer of funds. An escrow account held by a reputable third party (often a bank or specialized company) can provide added security and protection for both the buyer and seller.

The escrow company will oversee the transaction, holding the funds until all contingencies and requirements are met, at which point the money is released to the seller. This process helps mitigate risks and ensures a smooth transfer of ownership.

Sending Less Than $5,000 USD to MXN

For smaller amounts under $5,000 USD, you may be able to wire the funds directly to the recipient’s bank account in Mexico. It’s essential to use a reputable money transfer service and follow all reporting requirements for international transactions.

Most banks and money transfer services will require documentation, such as the recipient’s name, account information, and the purpose of the transfer, to comply with anti-money laundering regulations.

Sending More Than $5,000 USD to MXN

If you need to transfer more than $5,000 USD to Mexico for a property purchase, you’ll likely need to use a specialized currency exchange service or your bank’s international wire transfer service. These larger transactions may require additional documentation and compliance with anti-money laundering regulations.

It’s crucial to consult with your financial institution, real estate professional, or lawyer to understand the specific requirements and procedures for sending funds to Mexico for a property purchase. They can guide you through the process and ensure compliance with all relevant regulations.

Frequently Asked Question

Can Foreigners Legally Buy Property In Mexico?

Yes, foreigners can legally purchase and own property in Mexico under the same constitutional rights as Mexican citizens.

What Are The Restrictions For Foreign Property Ownership In Mexico?

Foreigners cannot directly own land or property in Restricted Zones near borders and coastlines but can acquire residential property rights through a fideicomiso (trust) or a Mexican corporation.

Do I Need To Become A Resident To Buy Property In Mexico?

Owning property doesn’t automatically grant residency, but it can support residency applications, showing commitment to Mexico.

What are the main risks when buying property in Mexico?

Risks include ejido land complexities, foreign ownership restrictions, title verification, property scams, construction quality, infrastructure, natural hazards, and cultural differences.

Do I Need A Lawyer To Buy Property In Mexico?

While not mandatory, hiring a Mexican real estate lawyer or notary is highly recommended to ensure legal compliance, title verification, negotiation assistance, and protection of interests.

Final Words

Buying property in Mexico as a foreigner can be a rewarding experience, offering the potential for investment opportunities, a retirement haven, or a vacation home in a beautiful and culturally rich country. However, navigating the legal and cultural landscape requires thorough research, professional guidance, and a deep understanding of the risks and requirements involved.

By following the tips and guidelines outlined in this comprehensive guide, you can make an informed decision and approach the property purchase process with confidence. Remember to work with reputable real estate professionals, conduct extensive due diligence, respect the local laws and cultural norms, and plan for all associated costs and taxes.

With careful planning and preparation, owning property in Mexico can be a gateway to a new lifestyle, investment opportunities, or a lasting connection to this vibrant and diverse nation. Embrace the journey, immerse yourself in the local culture, and enjoy the rewards of your Mexican real estate investment.

Robert, our website’s author, leverages 6 years of Real Estate expertise to provide insightful content. His wealth of experience enriches our platform, offering valuable insights for our readers.