NOI stands for Net Operating Income, a key metric used by investors to evaluate the profitability of income-generating properties. NOI is calculated by subtracting operating expenses from gross rental income. It provides a clear picture of a property’s financial health, excluding factors like financing costs and depreciation.

It is crucial in determining a property’s value and potential return on investment. Investors often use it to compare different properties or assess the impact of operational changes. For example, increasing rental income or reducing expenses can directly improve NOI and thus, the property’s value. Understanding NOI is essential for anyone looking to invest in real estate, as it helps gauge the potential income and overall performance of an investment property.

Understanding Net Operating Income (NOI)

Net Operating Income (NOI) is the financial pulse of a real estate investment, revealing its profitability. It’s found by subtracting operating expenses, such as maintenance, utilities, taxes, and management fees, from the property’s gross income. This simple calculation unveils how much money the property is generating after covering its essential day-to-day costs.

Investors rely on NOI to gauge a property’s financial health and compare investment options. Understanding NOI empowers investors to make informed decisions and maximize the potential return on their real estate ventures.

Related Post: How Much Does Real Estate Agents Make?

How To Calculate Net Operating Income (NOI)

Calculating Net Operating Income (NOI) is essential for understanding the financial performance of a real estate investment. To determine NOI, start by tallying up all the property’s annual rental income. This includes rent from tenants and any other sources, like parking fees. Next, subtract all operating expenses for the property over the same period.

Operating expenses typically cover costs such as property taxes, insurance, maintenance, and utilities. Once you have these figures, simply deduct the total expenses from the total rental income, and voila! You’ve got your Net Operating Income.

NOI Formula

Net operating income = 𝑅𝑅−𝑂𝐸

Where:

𝑅𝑅=real estate revenue

𝑂𝐸=operating expenses

Components Of NOI

Net Operating Income (NOI) in real estate consists of Gross Rental Income, Operating Expenses, and Exclusions. Gross Rental Income encompasses all revenue from renting the property, while Operating Expenses cover maintenance costs. Exclusions exclude certain expenses like financing costs, providing a clear view of operational profitability.

Rental Income

Picture this as the steady flow of income into your bank account from tenants occupying your property. Whether it’s residential apartments, office spaces, or retail units, the rent they pay forms the backbone of your NOI.

Operating Expenses

Just like maintaining a well-oiled machine, properties come with their set of expenses. These include property taxes, insurance premiums, ongoing maintenance, utilities like water and electricity, and management fees if you have a property manager. Subtracting these costs from your rental income gives you the NOI—the true measure of profitability.

Other Income

Sometimes, your property may have additional revenue streams beyond just rent. Think of income from parking fees, laundry facilities, vending machines, or even cell tower leases. These add-ons contribute to your NOI, making your investment even more lucrative.

Related Post: Digital Real Estate: What Is It & Why Should You Care About It?

Net Operating Income vs. Gross Operating Income

In real estate investment analysis, understanding the distinction between Net Operating Income (NOI) and Gross Operating Income (GOI) is crucial for making informed decisions.

Net Operating Income (NOI)

- Definition: NOI represents the total income generated by a property after deducting all operating expenses.

- Calculation: It is calculated by subtracting operating expenses (such as property taxes, insurance, maintenance, and property management fees) from the gross rental income.

- Significance: NOI provides a clear picture of a property’s profitability and cash flow potential, excluding factors like financing costs and depreciation.

- Use: Investors rely on NOI to evaluate the financial performance of income-generating properties and determine their investment viability.

Gross Operating Income (GOI)

- Definition: GOI refers to the total income generated by a property before deducting any operating expenses.

- Calculation: It is simply the sum of all rental income generated by the property.

- Significance: GOI offers insight into the property’s revenue-generating potential without considering the costs associated with its operation.

- Use: While GOI provides a snapshot of a property’s income stream, it alone does not reflect its true profitability. Investors often use GOI in conjunction with NOI to assess a property’s financial health comprehensively.

NOI and Cap Rate

When it comes to evaluating the investment potential of a property, understanding the relationship between Net Operating Income (NOI) and Capitalization Rate (Cap Rate) is essential.

Net Operating Income (NOI)

- NOI represents the income generated by a property after deducting all operating expenses.

- It provides a clear picture of the property’s profitability and cash flow potential.

- Calculating NOI involves subtracting operating expenses from the property’s gross rental income.

Capitalization Rate (Cap Rate)

- Cap Rate is a key metric used by investors to assess the rate of return on a property investment.

- It is calculated by dividing the property’s NOI by its current market value.

- Cap Rate helps investors compare the profitability of different investment opportunities and make informed decisions.

Relationship between NOI and Cap Rate

- There is an inverse relationship between NOI and Cap Rate.

- Higher NOI results in a lower Cap Rate, indicating a lower risk and higher value property.

- Conversely, lower NOI leads to a higher Cap Rate, suggesting higher risk and potentially lower property value.

In summary, understanding the relationship between NOI and Cap Rate is crucial for real estate investors to accurately assess the financial performance and investment potential of properties in their portfolio.

Example of NOI

Understanding Net Operating Income (NOI) through an illustrative example can clarify its calculation and significance in real estate investment analysis.

Consider a commercial property, such as an office building, generating $200,000 in annual rental income. To calculate the NOI, we subtract the operating expenses from this rental income. Let’s break it down:

- Gross Rental Income: $200,000 per year

- Operating Expenses: These may include property taxes, insurance, maintenance costs, utilities, property management fees, and any other expenses directly related to operating the property. For this example, let’s say the total operating expenses amount to $50,000 per year.

Given these figures, the calculation for NOI would be:

NOI = Gross Rental Income – Operating Expenses

= $200,000 – $50,000

= $150,000 per year

In this example, the Net Operating Income (NOI) for the commercial property is $150,000 annually. This represents the net income generated by the property after deducting all operating expenses.

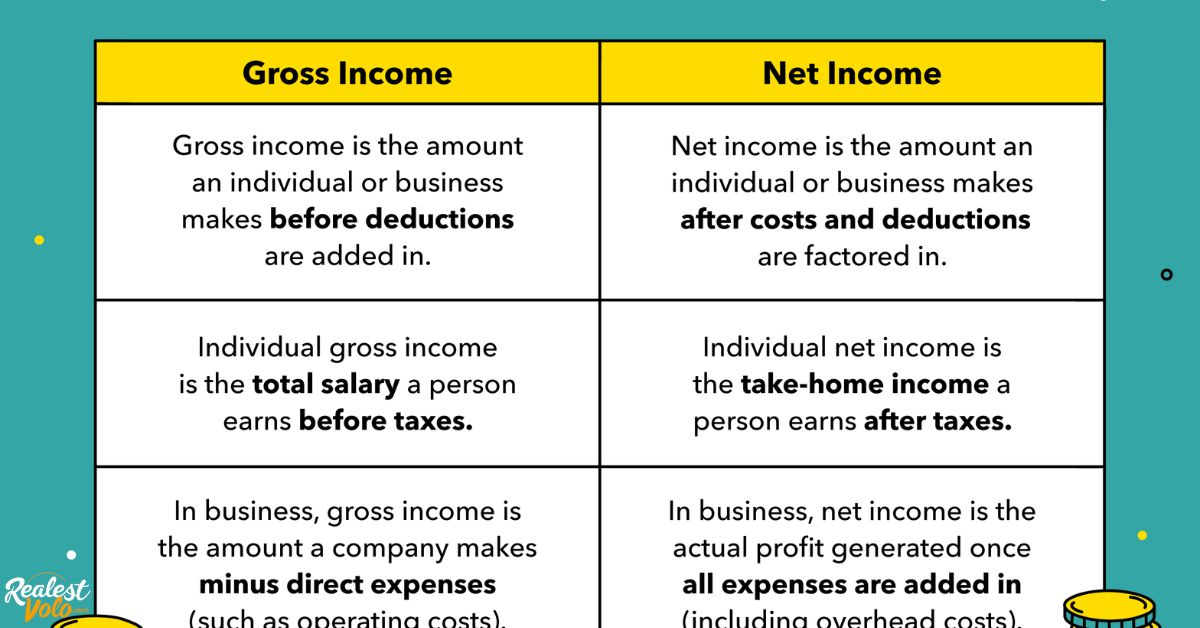

What Is the Difference Between Net Income and Net Operating Income?

Net Income

Net Income is like looking at the big picture of a property’s finances. It includes all the money the property brings in (like rent) and all the money it spends (like taxes, mortgage payments, and maintenance costs). So, it’s the total profit or loss after all the bills are paid. This number tells you how well the property is doing overall, considering everything from operations to financing.

Net Operating Income (NOI)

Now, Net Operating Income (NOI) zooms in on the operational side of things. It’s just about the money the property brings in from rent after subtracting the costs to keep it running smoothly, like maintenance, utilities, and property management fees. NOI leaves out the financial stuff like taxes and interest payments. It’s a focused view, showing how well the property is doing from its day-to-day operations.

What Is a Good Net Operating Income Percentage?

Determining a good Net Operating Income (NOI) percentage is crucial for real estate investors. While there’s no universal benchmark, a higher NOI percentage generally indicates better profitability. Factors like property type, location, and market conditions influence what is considered a good percentage.

Factors Influencing NOI Percentage

Several factors can impact the perceived value of a good NOI percentage. These include the property’s location, condition, and the investor’s overall investment strategy. Each property is unique, so understanding these factors is essential for setting realistic investment goals.

Market Variability

Market conditions also play a significant role in determining what constitutes a good NOI percentage. In competitive markets, achieving a high NOI percentage may be more challenging due to higher property prices and operating costs. Conversely, in less competitive markets, investors may find it easier to achieve a higher NOI percentage.

Frequently Asked Question

What is NOI in real estate?

NOI stands for Net Operating Income, representing the total income generated by a property after subtracting operating expenses.

How is NOI calculated?

NOI is calculated by subtracting operating expenses from the property’s gross rental income.

What are some examples of operating expenses included in NOI?

Operating expenses typically include property taxes, insurance, maintenance costs, utilities, and property management fees.

Why is NOI important in real estate investing?

NOI provides investors with a clear indication of a property’s financial performance and profitability, helping them assess its potential return on investment.

How does NOI impact property valuation?

NOI is a key factor in determining the value of income-generating properties. Higher NOI typically leads to higher property valuations, as it indicates greater income potential for investors.

Final Words

Net Operating Income (NOI) serves as a cornerstone in real estate investment analysis, offering invaluable insights into a property’s financial health and income-generating potential. By subtracting operating expenses from gross rental income, NOI provides investors with a clear picture of the property’s profitability and cash flow.

Understanding NOI enables investors to make informed decisions, evaluate investment opportunities, and assess the performance of income-producing properties accurately. As such, mastering the concept of NOI is essential for anyone looking to navigate the complex landscape of real estate investing with confidence and foresight, paving the way for successful ventures and sustainable growth.